Orlando: Still Booming?

- Dennis Lee

- Aug 12, 2025

- 2 min read

by Dennis Lee, CEO at Market Stadium

Orlando is booming, again.

According to Berkadia’s Cole Whitaker and Brett Moss (Southeast Real Estate Business, July 2025), the city leads the U.S. in job and population growth, thanks to major developments, infrastructure upgrades, and strong in-migration. With new supply cooling and long-term demand intact, Orlando remains one of the nation’s top multifamily markets.

🔍 So I was curious…. which submarkets in Orlando look the most compelling?

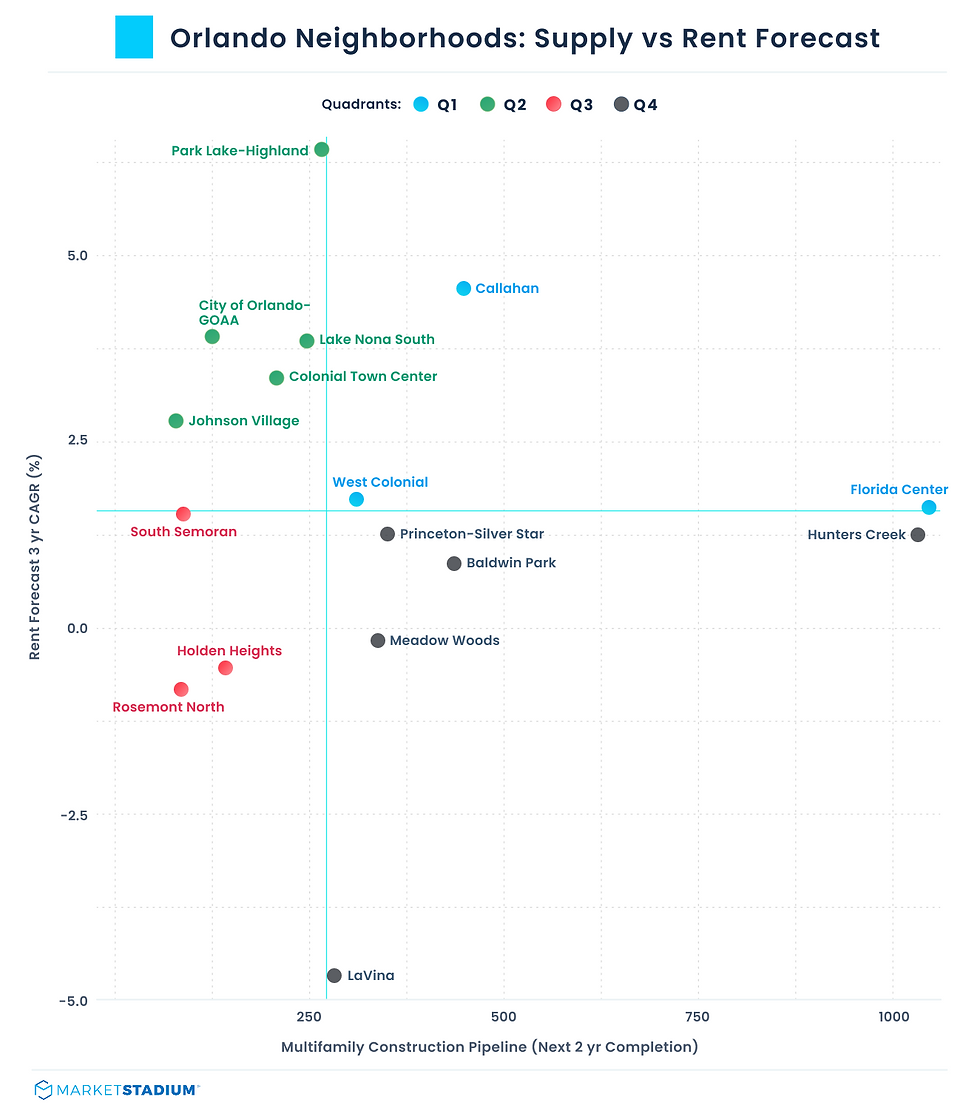

🔹 Orlando Neighborhoods: Mapping Supply vs. Rent Growth

We analyzed Orlando’s multifamily submarkets by plotting projected construction completions over the next 2 years (supply pressure) against 3-year rent growth forecasts (demand strength). This quadrant analysis highlights which areas may offer more attractive investment conditions based on their supply-demand outlook.

Quadrant Breakdown:

🟦 Q1 – High Supply, High Rent Growth

💡 Momentum Markets: Active construction pipeline but strong demand keeps rent outlook robust.

Example submarkets: Florida Center, Callahan

Despite above-average new supply, these areas show solid rent growth potential — signaling investor confidence or exceptional location fundamentals.

🟩 Q2 – Low Supply, High Rent Growth

💡 Undersupplied Hotspots: Constrained pipeline with strong future rent upside.

Example submarkets: City of Orlando-GOAA, Lake Nona South, Colonial Town Center, Johnson Village

These are perhaps the most attractive submarkets, combining low competition with strong rent acceleration. Ideal for yield-focused or strategic growth investors.

🟥 Q3 – Low Supply, Low Rent Growth

💡 Stable or Lagging Areas: Quiet construction activity but limited upside in rents.

Example submarkets: South Semoran, Rosemont North

These neighborhoods may reflect stable renter bases or saturated pricing — offering low volatility but also limited near-term upside.

⬛ Q4 – High Supply, Low Rent Growth

⚠️ Risk Zones: Rising inventory with flat or declining rent forecasts.

Example submarkets: Meadow Woods, Baldwin Park, LaVina

High pipeline pressure paired with muted demand may create lease-up risks or overhang — caution may be warranted in these areas.

This isn’t just data — it’s your head start on the next big thing.

Click the Book Demo button in the top navigation bar for a personalized walkthrough.

Explore our Product page or walkthrough website anytime for more info on features we provide!

Dennis Lee

CEO at Market Stadium

Prev. Lionstone Investments Research Team

Comments